The market is in the midst of a consolidation. But, Ankit Mandholia, of Motilal Oswal Financial Services Ltd, believes that this will kick off the next leg of growth.

After moving sideways for a year and entering into a more mature, earnings-driven phase, the market throws up an opportunity for startups, particularly those aiming to be projected as sustainable businesses, ready for public scrutiny.

Public market valuations aren’t a reward but a reality check, underscoring that the next wave of startup IPOs will mark a shift from the growth-at-all-costs mindset towards profitability, strong governance, and capital efficiency – qualities that will isolate enduring companies from speculative ventures, according to him.

Mandholia, who leads equity, derivatives, and wealth management at MOFSL, expects earnings to rebound meaningfully, with earnings shooting off 10% in FY26 and 14% in FY27. “The next leg of this rally will be driven not by hope but by proof – companies actually delivering on earnings,” he said.

What intrigues an observer is a decline in valuation, despite a steady rise in prices. In a fast-expanding economy like India, this correction looks sustainable, and not stretched. This creates a comfortable entry point for quality names that can derive tangible shareholder value.

“India’s growth story is maturing, and so are its markets,” Mandholia said. “The winners will be those companies and founders that can deliver earnings, not just ambition.”

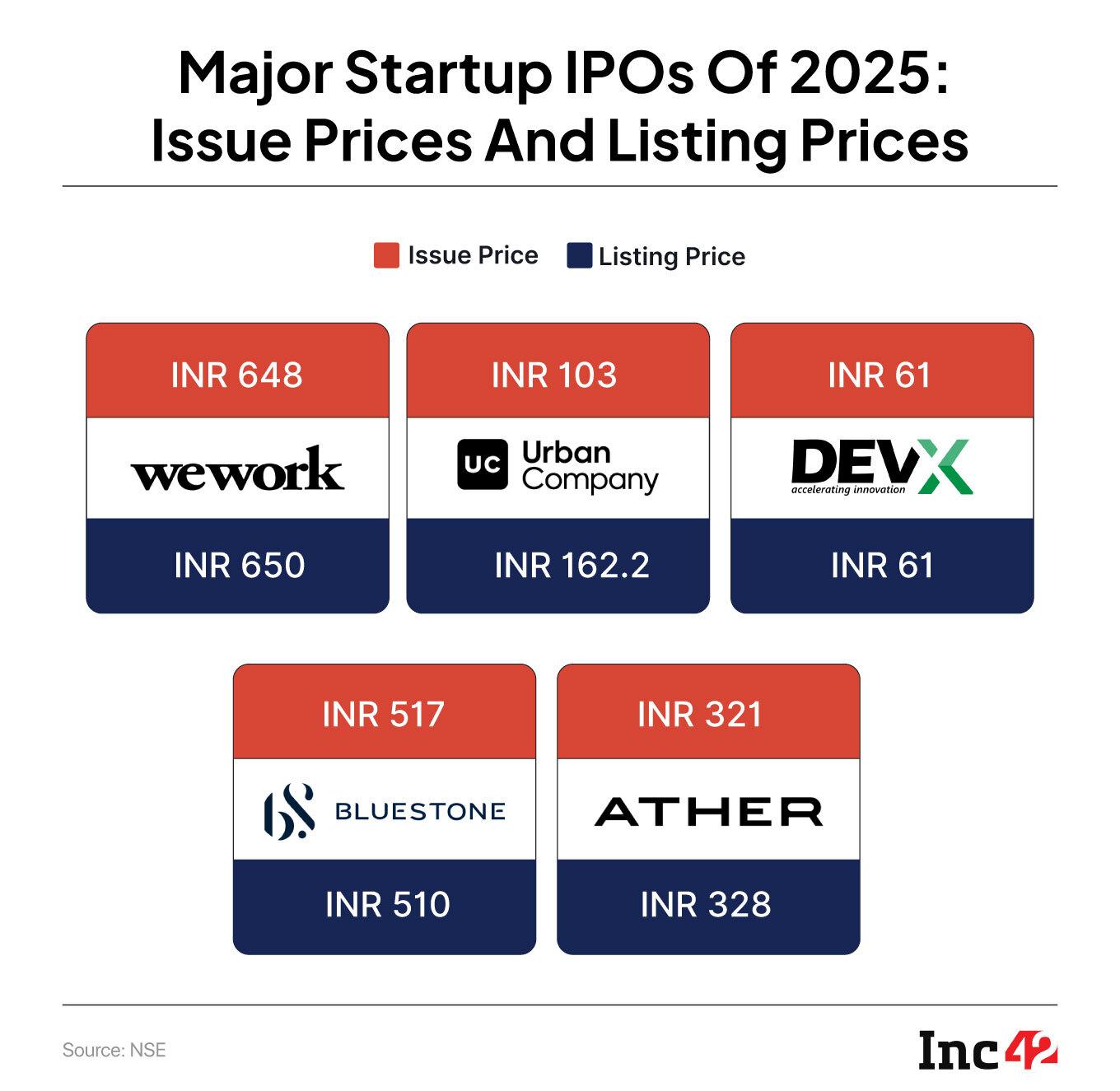

It is the same filter that differentiates even startups rushing for the capital market. After the D-Street frenzy of 2020–21, the pipeline looks more balanced today, featuring firms from manufacturing, fintech, and consumer sectors alongside tech startups. Pricing has become more rational, disclosure standards more stringent, and domestic liquidity, through SIPs, pension funds, and insurance flows, stronger than ever.

Mandholia believes this combination of disciplined capital formation and robust local participation marks a structural turning point for the market. Both public and startup ecosystems are converging on this trend. Durable, well-governed, and profitable businesses will define the next decade of wealth creation.

Private Hype To Public AccountabilityThe age of storytelling is over – it’s the era of accountability. A public float is no longer a founder’s exit play, but has turned into a credibility test of governance, profitability, and sustainability. Investors are looking beyond narratives to assess business quality, scalability, and cash flow resilience.

“The ability of a business to sustain itself without continuous capital infusion is essential,” Mandholia said. “Companies merely burning cash without a clear path to profitability pose higher risks.” Founders who focus on margins, retention, and execution see stronger post-listing performance – a proof that the market now values discipline over daring.

It’s not just the flurry of public issues, the IPOs in the startup ecosystem have fuelled a raging debate over the high portion of the offer-for-sale (OFS) component. Most of the recent IPOs have made it a trend, raising frowns over their intent. Investors questioned whether the companies were genuinely raising growth capital or merely providing exits to early backers.

“A disproportionately high OFS may indicate that early investors are heavily exiting, suggesting limited commitment to the company’s long-term growth. While some level of OFS is normal and healthy for providing liquidity, an excessive share can be a red flag. Conversely, if the OFS is within reasonable limits and the company’s fundamentals remain strong, the IPO could still represent a quality investment opportunity,” argued the MOFSL executive. The OFS, according to him, should be seen as a signal of balance, and not a stigma.

Mandholia outlined four pillars that define a fundamentally sound IPO – business quality, profitability, governance, and valuation sanity. Strong boards, credible audits, and rational pricing are non-negotiable. “It’s the combination of these four elements that determines whether an IPO is fundamentally sound or speculative,” he said.

This maturity is mirrored in the regulatory system, too. The reform policies for the primary market laid out by SEBI recently, involving faster approvals, richer disclosures, and improved fund-blocking mechanisms, have firmed up investor confidence and streamlined capital raising. The result is a broader, more disciplined IPO market, not dominated by a single theme.

“This diversification is healthy,” Mandholia noted. “It shows that domestic investors are becoming more mature, valuing governance and cash flow discipline over hype.”

India’s startup-to-IPO journey represents the maturity of its capital market from funding promises to funding proof. Founders learned that public markets reward transparency, profitability, and longevity, not just growth projections.

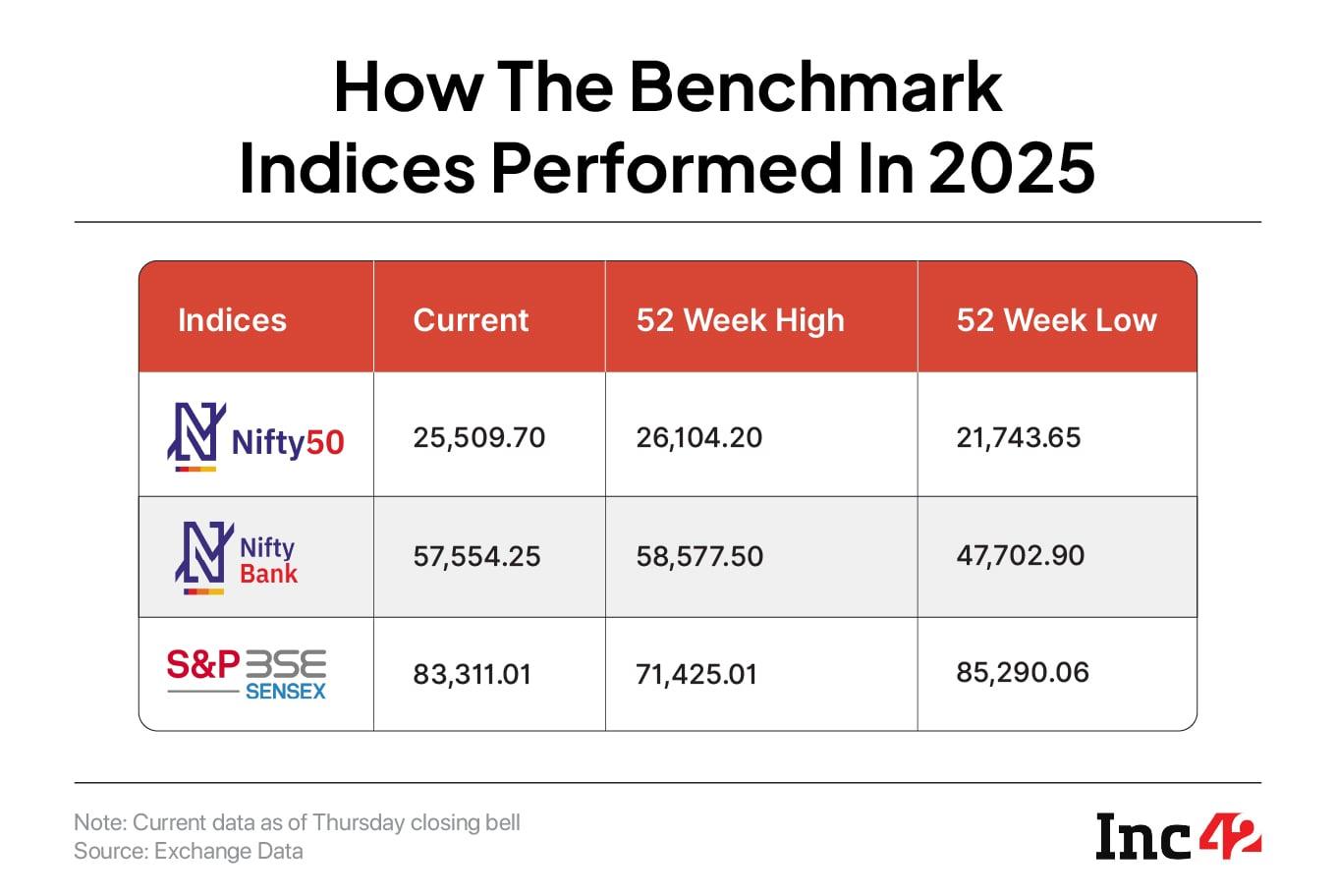

If India’s startup ecosystem is maturing from hype to accountability, the same format is playing out across its public markets where investors are shifting from liquidity-driven optimism to earnings-backed conviction. While the benchmark indices hover near record highs, the true earnings story is yet to unfold.

“The market hasn’t fully priced in the next phase of earnings growth,” Mandholia said. Over the past few quarters, Indian equities have moved largely sideways – neither correcting sharply nor advancing significantly. The hesitation, he noted, stems from muted earnings momentum, sustained foreign institutional selling, and a cautious global environment shaped by interest rate uncertainty and trade tensions. “This phase of consolidation may be a precursor to a more sustainable rally built on profit delivery, rather than sentiment.”

Mandholia expects corporate earnings to rise around 10% in FY26 and 14% in FY27, providing a strong foundation for a fresh market rally.

Sending out a strong signal of stability, valuations too have also normalised. A year ago, the Nifty was trading at 24–25 times one-year forward earnings. Today, that multiple has moderated closer to the 10-year average of 20 times, suggesting that prices are now better aligned with fundamentals, offering investors a more reasonable entry point even at seemingly elevated index levels.

Mandholia sees the absence of a deep correction as a reflection of resilience, not complacency. “The market has absorbed a lot, including earnings disappointment, global volatility, and FII selling without breaking down,” he said. “That tells you the underlying structure is strong.”

With policy continuity, domestic liquidity, and growth in fundamentals, he expects the market to transition into an earnings-led expansion cycle over the coming quarters.

This outlook underscores a broader transformation – both IPO-bound startups and listed companies are being judged by delivery, and not by narratives. The balance between valuation and earnings is up for a recalibration and that, Mandholia believes, will kick off a durable and disciplined bull run.

As earnings begin to take the centre stage, the market relies not just on corporate performance, but also on its structural resilience. The capital market has reached a phase of self-reliance: one where domestic investors are setting the tone, not foreign flows.

“India is no longer an FII-dependent market,” Mandholia said. “The real story is the power of domestic liquidity.”

Systematic Investment Plans (SIPs), insurance inflows, pension funds, and direct retail participation have built a steady inflow base that cushions volatility and sustains market momentum even in times of global turbulence. This homegrown capital formation, according to him, is one of the most significant structural shifts in India’s financial ecosystem over the past decade.

Numbers back up Mandholia’s observation. Monthly mutual fund SIP inflows consistently exceeded INR 20,000 Cr and long-term domestic savings are increasingly being channeled into equities. This solid foundation has helped Indian markets to absorb the impact of FII selloff without being destabilised. It was unthinkable even a decade back.

Mandholia believes this not only reflects stronger financial literacy, but also rising household confidence in equities as a long-term wealth creation tool.

The cautious stance taken by FIIs because of global uncertainties, valuation concerns, and risk aversion, appears increasingly untenable. “At some point, staying underweight on India becomes hard to justify,” Mandholia said.

With a 6.8% GDP growth rate, policy stability, and a disciplined corporate earnings cycle, India offers one of the most compelling macro stories. As investors seek growth in an otherwise sluggish world, the combination of scale, stability, and profitability that India offers will be difficult to overlook.

Policy continuity and fiscal discipline have also been critical in reinforcing confidence. Government-led infrastructure spending, formalisation of the economy, and the push for manufacturing and digitisation have created durable growth levers for the market. “India’s resilience today is built on multiple engines – consumption, credit, and capex – all domestically powered,” Mandholia said.

Defining Equity Story For The Next DecadeThe Motilal Oswal executive believes the next decade of wealth creation will hinge on select structural themes like discretionary spending, evolving lifestyle, and growth in manufacturing, defence, and energy transition. India’s consumption story is moving from essentials to aspirations, favouring brands that combine pricing power with credibility and flawless execution.

The IPO structures will be crucial, especially around the OFS share. “A balanced structure signals maturity,” Mandholia said, “while excessive exits can still raise red flags.”

By 2030, he argued, the true test of India’s market success will rest on three pillars – participation, reflecting the depth of retail and institutional engagement; resilience, shown in its ability to absorb global shocks; and returns, sustained through value-driven wealth creation.

[Edited by Kumar Chatterjee]

The post From Hype To Discipline: How India’s Markets Are Maturing Across Startups And Stocks appeared first on Inc42 Media.

You may also like

Unity SFB leads Aviom India Housing race with Rs 775-cr bid

When is Kawhi Leonard returning? NBA star's ankle setback deepens Los Angeles Clippers' early-season troubles

Doctor among three held by Gujarat ATS in terror case

Novak Djokovic defended by rival after being left in 'strange situation'

Foil 'vote chori', make INDIA bloc win: Rahul Gandhi